Product & Customer Profitability Analysis - A Vital Tool For Strategic Planning

A tough strategic choice

A manufacturer of electronic and electromechanical measuring devices that has a well earned reputation for R & D, quality and service support. Though the dominant supplier in the UK market, two years ago this position came under threat from cheaper imports. In response, it had outsourced much of the component assembly to China keeping the final kit assembly in the UK. It had matched the competition for price, enhanced customer service levels to its larger volume customers, and commissioned a new state of the art final assembly plant in the UK. However, the squeeze on gross margins in the UK was relentless – leaving the board with a tough decision.

On the one hand it could stick to the UK market, weather the competition, and use its R&D skills to push forward the development of new ‘smart’ technology that would command higher prices. This first option was attractive but the R&D team was still two years away from making the new technology available for commercial use, and the market for smart technology was still unknown. On the other hand, it could seek overseas business using current technology in markets that were expected to grow quickly in the short term.

They selected this second option, appointed agents who knew the local markets to recruit new customers, and reduced the manufacturing costs further by placing the final assembly for those products overseas as well.

Before long they had signed up new business around Europe, in Scandinavia, the Middle East, Africa and North and South America. And when Australia and New Zealand appeared on the books the company felt that it was truly a global business. With the perceived risks and benefits known at the time they had made the right decision and top line sales began to grow.

Growing concerns

It had been anticipated that product types would proliferate. UK products would have to be adapted to meet local specifications and manufacture and test techniques would have to become more diverse.

The number of employees grew and a strong international flavour developed as sales and engineering people travelled all around the world. For most businesses this would represent positive signs of growth. However, top line sales increases were no longer translating into a growth in profitability. Two years down the line, sales were up, but profitability was sliding.

An astute decision

So far, the company had read the market shrewdly and made some astute decisions. But the next key strategic decision was less easy to make. With smart technology soon to be available for commercial use in the UK – should they continue to pursue business across all their markets?

With complex specifications to meet, hardware and software issues had been experienced with almost every overseas customer. Recalling and replacing products had kept the customers placated, but the cost had been high and blame soon followed:

“It’s a wonder that we make any money at all with engineers flying to China each month”

“Once again R&D have installed the wrong software in the Spanish units”

“Why are we shipping the items for Norway by air freight?”

Cool heads decided that a strategic decision made in haste and influenced by anecdote might be unwise. A thorough analysis of profitability for all the products and customers was agreed to be the best way forward. If it’s understood where and how costs have been created it will be easier to decide what to do. The board needed to know the profitability of the business in three dimensions: country, customer and product.

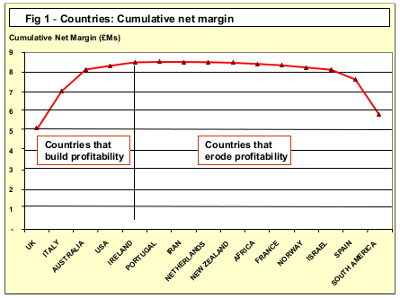

Country profitability

see Fig 1

By country, it became clear the extent to which the additional revenue from overseas markets had come at a price. Only four had contributed any net margin.

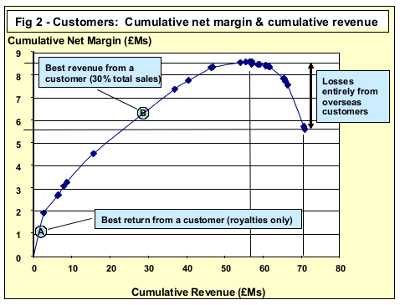

Product profitability

see Fig 2

By customer, the contribution to margin was compared with the contribution to revenue (each line between points is a customer). Almost all the customers that had destroyed margin were from overseas markets. They had turned products away, they had demanded support that the local agents were unable to provide, and they had delivered the least revenue per unit purchased due to the size of the commission owed to the local agents.

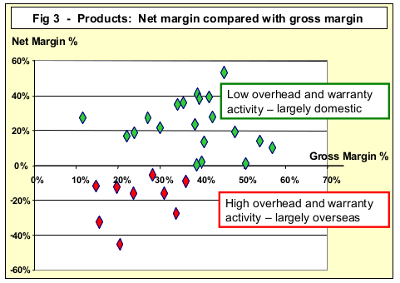

Product profitability

see Fig 3

By product, the gross margin was compared with the net margin. For those destined for the overseas customers a healthy gross margin became a negative net margin under the burden of the high warranty related costs and overhead activity.

Scenario planning in action

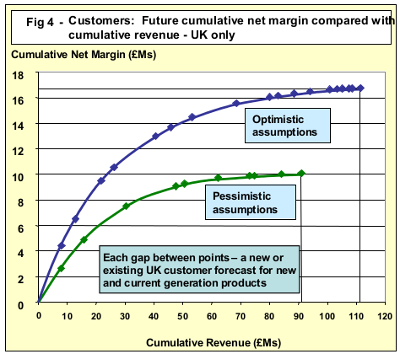

see Fig 4

For strategic planning this was essential information available at the right time. Two years ago the overseas markets strategy was serving its purpose but the profitability analysis now suggested that a change in strategic direction was required.

Several key scenarios could now be modelled. The most important by far was that envisaged at the start - with smart technology now present in several prototype parts, should all efforts be focused towards the UK market?

This would mean: leaving overseas customers solely in the hands of local agents and ceasing all overseas customer support (although royalties would be received for any parts sold); putting every ounce of effort into securing the UK market for smart devices – likely to be priced 400% above current prices; exploiting the efficiency gains from the new final assembly plant that had come on line.

The prediction at Figure 4 was quite clear. Even with the most pessimistic of assumptions the revenue and profitability forecast for the customer base in the UK would far exceed the current business with the overseas markets in tow.

Sharp minds and smart decision support

The sharp minds at the helm would almost certainly have navigated the business around all these rocks and got the business to a reasonable destination.

But smart decision support from the product and customer profitability analyses brought them there far faster and provided them with the certainty of making the correct decision.

The analysis approach is now embedded in the business as a key planning support tool. And that means forecasting with confidence – rolling strategic planning - and being able to predict accurately the consequences of their decisions.